Image courtesy: INDRANIL MUKHERJEE/AFP/Getty Images

The Reserve Bank of India (RBI) enters 2025 under new leadership, with Sanjay Malhotra taking over as governor after Shaktikanta Das’s six-year tenure marked by a steadfast focus on inflation control. The upcoming monetary policy review in February is being watched closely as the new governor navigates the growing demands for a rate cut to boost economic growth.

Legacy of Shaktikanta Das

Shaktikanta Das, known for his crisis management during demonetization and the COVID-19 pandemic, maintained an unwavering focus on inflation, even at the expense of economic growth. The RBI kept interest rates unchanged for two consecutive years, despite GDP growth slipping to a seven-quarter low in July-September 2024. Das defended the policy by emphasizing the need to protect the credibility of the flexible inflation targeting framework.

Das’s tenure also saw significant achievements:

- A framework for surplus transfers led to a record ₹2.1 lakh crore dividend to the government in 2024, aiding fiscal targets.

- Advances in non-performing asset (NPA) management, though some cyclical upticks in bad loans are anticipated.

- Firm opposition to cryptocurrency on financial stability grounds.

- Operationalization of the e-rupee, which Das described as the “currency of the future.”

Despite these successes, the RBI’s stance on high rates drew criticism from policymakers, including Finance Minister Nirmala Sitharaman, who openly advocated for rate cuts to support growth.

Challenges for Sanjay Malhotra

Sanjay Malhotra’s appointment comes at a critical juncture. The RBI’s growth forecast for FY25 was revised down to 6.6% in December 2024, reflecting concerns over economic momentum. Meanwhile, inflation remains volatile, with October’s consumer price index breaching the 6% threshold.

Key factors influencing Malhotra’s decision on rate cuts include:

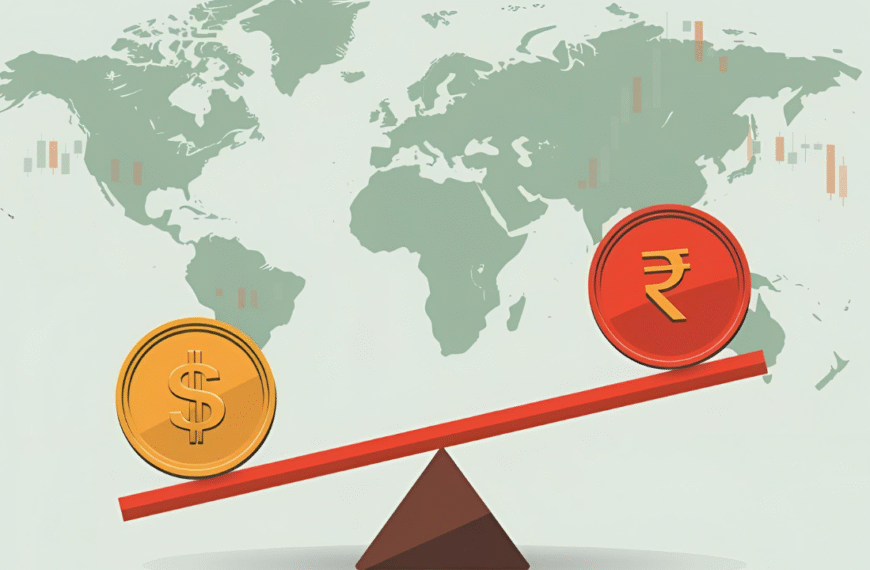

- Global Dynamics: The U.S. Federal Reserve’s slower-than-expected rate cuts could impact India’s currency stability and capital flows. The rupee’s decline to an all-time low of ₹85 per dollar adds pressure.

- Domestic Demand: High inflation has dampened consumer spending, while regulatory measures have constrained credit growth, especially in discretionary segments like personal loans and credit cards.

- Monetary Policy Committee (MPC): Five of the six MPC members, including three external members who joined in October 2024, are relatively new. Growing dissent within the committee favors a rate cut, but the extent remains debatable.

Growth vs. Inflation

The RBI’s October 2024 shift in monetary policy stance to “neutral” from “withdrawal of accommodation” signaled a potential pivot. Analysts widely expect a shallow rate cut of 0.50%, but questions remain about its efficacy in spurring economic activity.

Deputy Governor Michael Patra attributed the growth slowdown to high inflation suppressing demand, creating a feedback loop of weak private investment and slower GDP expansion. A rate cut could break this cycle but risks undermining the RBI’s inflation credibility.

Looking Ahead

Sanjay Malhotra has emphasized growth, stability, and trust as his guiding principles. His leadership will be tested in February when the RBI’s monetary policy review convenes with a largely new MPC.

As Malhotra steers the central bank into its “Amrit Kaal,” balancing growth aspirations with inflation control will define his tenure. Whether the RBI delivers a rate cut and how it manages its broader mandate will shape India’s economic trajectory in 2025 and beyond.